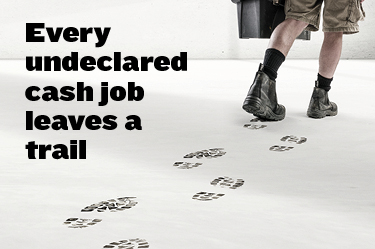

Tradies are being reminded that every undeclared cash job leaves a trail in a hard-hitting campaign from Inland Revenue.

The message will start appearing around Auckland, Wellington and Christchurch over the next few days as part of a long-running programme to address tax crime in the building sector.

Investigation work into the hidden economy uncovered $159 million worth of unpaid tax in the last year.

Watch some kiwi builders talk about why declaring all their income is important for their business and reputation.

Inland Revenue Marketing and Communications Group Manager Andrew Stott says research shows that although most are doing the right thing, a large proportion of undeclared cash jobs are being paid for services like building, plumbing, painting and electrical work.

“There’s a misconception out there that this work flies under Inland Revenue’s radar but undeclared income leaves a trail, which can be easily uncovered when looking for irregularities in a tradie’s books.

“You place yourself in a difficult position when you accept these jobs so the best advice is to record everything, declare every dollar and make sure you’re charging GST if required.

“If you have been doing undeclared cash jobs, we can help you get back on track.”

Look out for the campaign posters

A recent Inland Revenue survey found a quarter of respondents were still prepared to pay their tradie with cash compared to 35% when the question was first asked six years ago.

“It’s great that fewer people are paying cash jobs,” says Mr Stott. “More people are aware that not declaring them is against the law.

“They’re grossly unfair on the tradies who play by the rules and they take away funding earmarked for improved public services.

“We’re trying to make people in the construction industry aware that there’s a risk associated with not declaring a cash job.

“Hopefully this makes them think hard about whether the risk is worth it.”

Inland Revenue can help you do the right thing at www.ird.govt.nz/getitright.