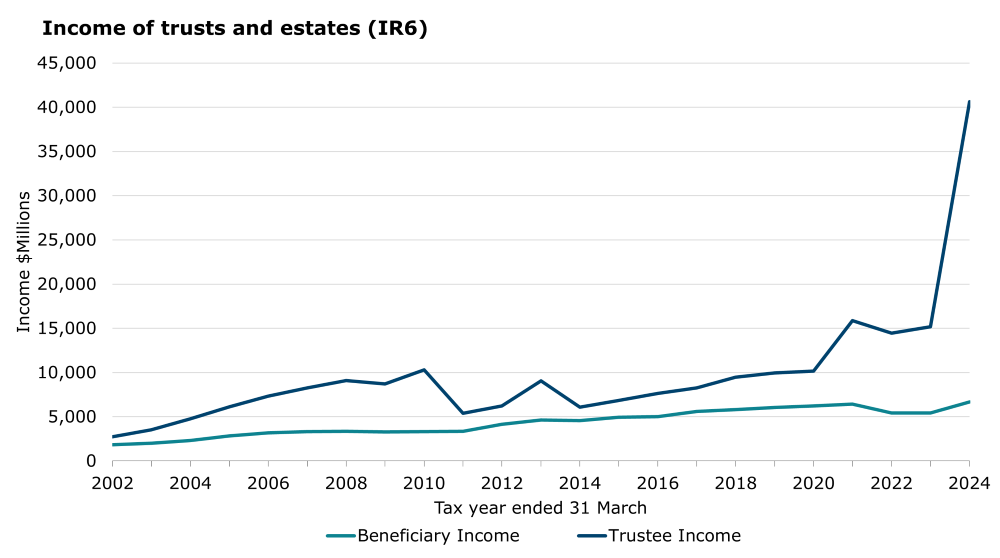

In the 2024 tax year, the income of trusts and estates from filed IR6 returns totalled $47.3 billion. This is an increase of 129.7% since 2023.

Over the period 2001 to 2023, trusts and estates have typically received between 40% to 70% of their income as imputed dividends from companies. Much of the volatility in trustee income seen over the 2001 to 2023 period is because of volatility in dividends paid by companies to their shareholders.

Between the 2001 to 2010 tax years, trustee income grew by 420% ($8.3 billion). The growth in income between 2001 and 2010 was driven by both an increase in the volume of trusts filing returns and by the aggregate value of dividends received.

In the 2009 tax year the company tax rate dropped from 33% to 30%. The company tax rate dropped again in the 2012 tax year to 28%.

Following both changes to the company tax rate, companies could attach imputation credits to dividends with reference to the higher preceding company tax rates for an additional two years. The changes in the company tax rate and the ability to impute dividends at a higher rate for a short period resulted in a spike in trustee income in the 2010 and 2013 tax years as companies temporarily increased their dividend payments to their shareholders.

Trustee income dropped substantially in the years following the higher dividend payments (2011 and 2014 tax years) as firms adjusted their dividend distributions after the higher pay-outs in the preceding years.

From 1 April 2021, the personal income tax scale changed with the introduction of a higher rate of 39% for people with income over $180,000. The growth in trustee income in the 2021 tax year reflects high profitability and high dividend payouts in that year.

There was an additional incentive for companies to pay out current and/or previous years retained earnings as imputed dividends to their shareholders, including trusts, prior to the introduction of the 39% top personal tax rate. The increase in dividends received by trusts was generally taxed at the trustee income tax rate of 33% with the relative amount of income allocated to trustees (rather than beneficiaries) increasing from 62% in 2020 to 71% in 2021.

In the 2024 tax year, trustee income increased by 167.5% to $40.6 billion compared to the prior year. Income allocated to beneficiaries increased by 23.3% to $6.7 billion. As a result of the sharp increase in trustee income, the share of income allocated to trustees increased further from 74% in 2023 to 86% in 2024, while the share allocated to beneficiaries decreased from 26% in 2023 to 14% in 2024.

The increase in trustee income in 2024 was driven by an increase in dividends paid by companies to their trust owners ahead of the increase in the trustee tax rate to 39% on 1 April 2024. In the 2024 tax year, dividends received by trusts increased by $25.8 billion (194%) to $39.1 billion.