Income tax Dates

-

FEB 9End-of-year income tax and Working for Families bills are due, unless your tax agent has an extension of time to file your income tax return.

-

MAR 2AIM instalments are due if you have a March balance date.

-

MAR 2Provisional tax payments are due if you have a March balance date and use the ratio option.

In the following scenarios we compare the accounting income method (AIM) to the standard, ratio, and estimation provisional tax options. These scenarios look at types of businesses that could most benefit from AIM because they are:

- new or growing

- earning irregular or seasonal income

- unable to accurately forecast their income.

Scenario

Lydia is an avocado farmer and earns her profit between September and April.

How Lydia pays provisional tax

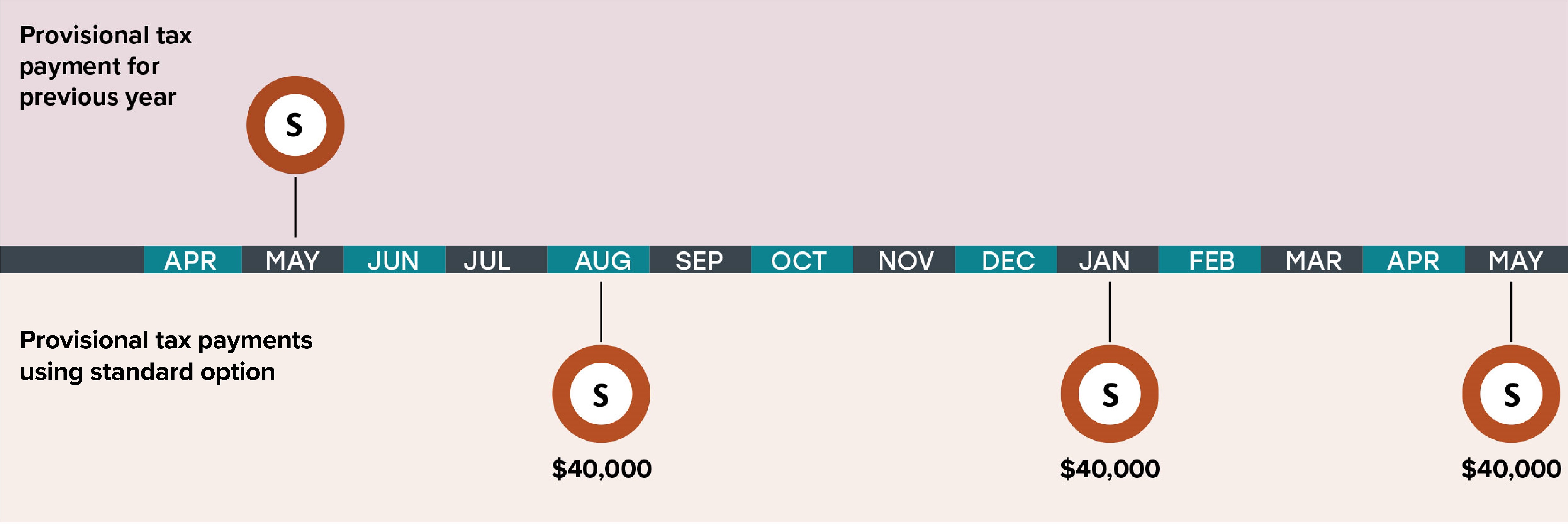

Lydia uses the standard option to work out her provisional tax because her profits usually increase year to year.

Based on last year’s end-of-year tax assessment, she needs to pay $120,000 for her provisional tax this year. She makes a $40,000 payment in August, January and May. The August payment is difficult for Lydia because she makes most of her money between September and April.

How Lydia's year shapes up using the standard option

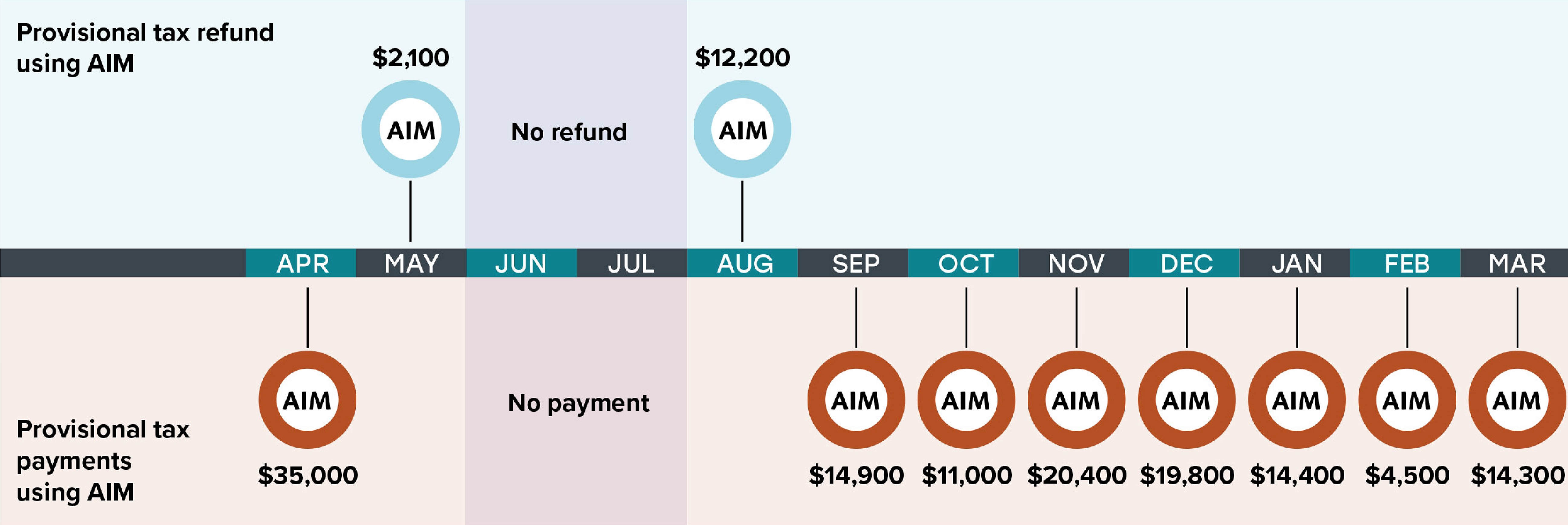

How Lydia could benefit from AIM

Lydia would pay her provisional tax based on the money she made throughout the year. Lydia’s software would calculate smaller, more frequent payments. These would align with her cash flow when she submits her monthly statement of activity. Since her income fluctuates, she could request a refund for overpaid tax in the current year instead of waiting until year end. AIM is the only provisional tax option that allows this.

How Lydia's year shapes up using AIM

Conclusion

Lydia finds it easier to manage her provisional tax payments using AIM and now has more time for maintaining her avocado farm during the busy season.

Scenario

John is a commercial fisher and owns his own boat. He can claim his boat as a depreciable asset, which will reduce his income tax.

How John pays provisional tax

John uses the ratio option to work out his provisional tax because his income fluctuates.

John's provisional tax lines up with his two-monthly GST returns. He pays 6 provisional tax payments during the year, based on his GST taxable supplies, totalling $59,800. He includes his depreciation expense in his end-of-year tax return which results in an assessment of $47,800. As it turns out, he gets a refund of $12,000 for overpaid tax.

How John's year shapes up using the ratio option

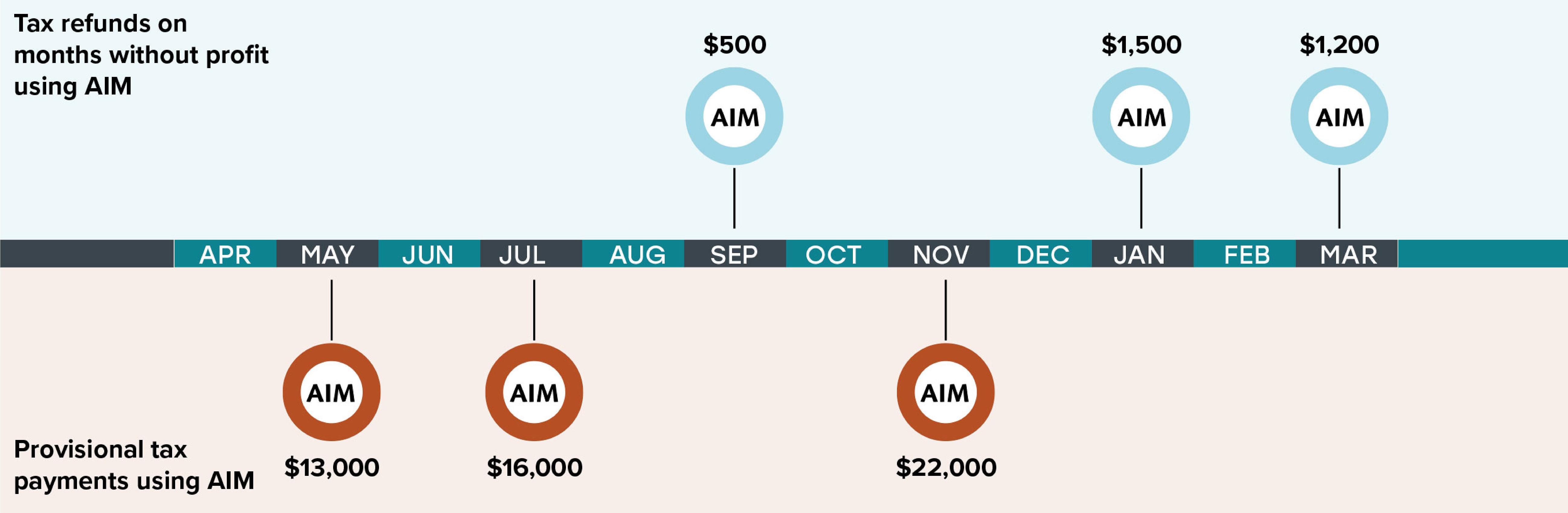

How John could benefit from AIM

Instead of waiting until year end, John would include his boat's depreciation expense when submitting his statement of activity every 2 months. He would end up paying less money when he made a profit and get money back on months he did not.

How John's year shapes up using AIM

Conclusion

John does not need to wait to receive his refund, making his cash flow easier to manage. When he files his end-of-year tax return there is no refund or further tax to pay because he already accounted for his income and expenses using AIM.

Scenario

Hemi and Aroha run a small film production company and their income changes a lot based on contracts they win for jobs.

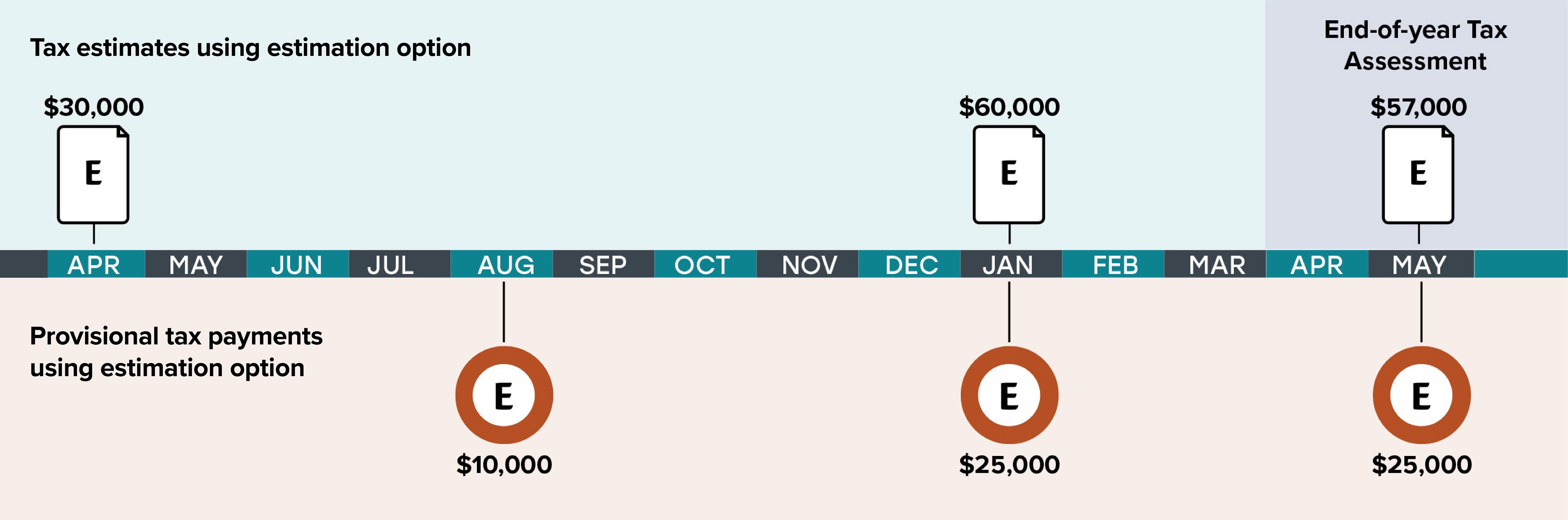

How Hemi and Aroha pay provisional tax

Hemi and Aroha are unsure how much they'll make each year, so they use the estimation option. They estimate that they'll owe $30,000, and make their first $10,000 payment in August.

Over Christmas they win a new film contract. Hemi contacts IRD in January to increase their estimate to $60,000 based on the extra income. They make their next 2 payments of $25,000 in January and May based on the new estimation.

When they file their end-of-year tax return, they get a $57,000 tax assessment. Since they made their payments on time, they do not receive any penalties. But, interest is calculated on the difference between $19,000 (one third of the assessment) and the tax paid on each date.

How Hemi and Aroha's year shapes up using the estimation option

How Hemi and Aroha could benefit from AIM

Hemi and Aroha would send us a statement of activity every month when they file their GST. They would only need to make provisional tax payments in June, December and January, when they made their profit. Their software would work out that nothing was due to be paid on the months that they did not earn an income.

How Hemi and Aroha's year shapes up using AIM

Conclusion

Hemi and Aroha will not need to re-estimate their provisional tax if they earn more income. Also, they will not be charged interest due to underestimations if they pay what their software tells them to, in full and on time. They're less stressed and have more time to focus on growing their business.