This section describes the use of three core channels for filing tax data:

- eFiling - this includes: e-File which allows tax agents to file tax returns online, and ir-File which enables employers to send their employer monthly schedules securely to Inland Revenue online.

- Online filing using myIR Secure Online Services - this includes all online filing except for the eFiling methods mentioned above, and.

- Paper-based filing - this includes all physical filing.

The data for these statistics is available for download from the links at the bottom of the page.

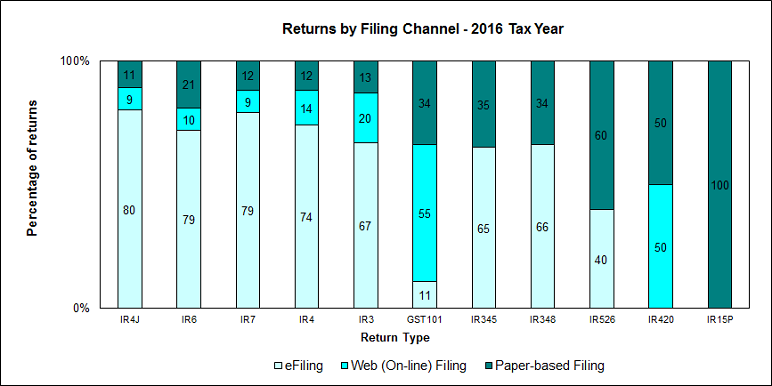

Graph of returns by filing channel - 2016 tax year

The graph shows the proportion of returns (eleven separate return types) filed for the 2016 tax year by filing channel (eFiling, online and paper-based).

The following patterns are evident:

- mainly eFiling - IR4J, IR6, IR7, IR4, IR3

- 55% Online, 34% paper-based and 11% eFiling - GST101

- two-thirds eFiling and one thirds paper-based - IR345, IR348

- 60% paper-based and 40% eFiling - IR526

- half Online and half paper-based - IR420

- completely paper-based - IR15P.

Last updated:

28 Apr 2021