In the 2024 tax year, the total amount of taxable income was $268.0 billion. That number is a 10.1% increase compared to the 2023 tax year.

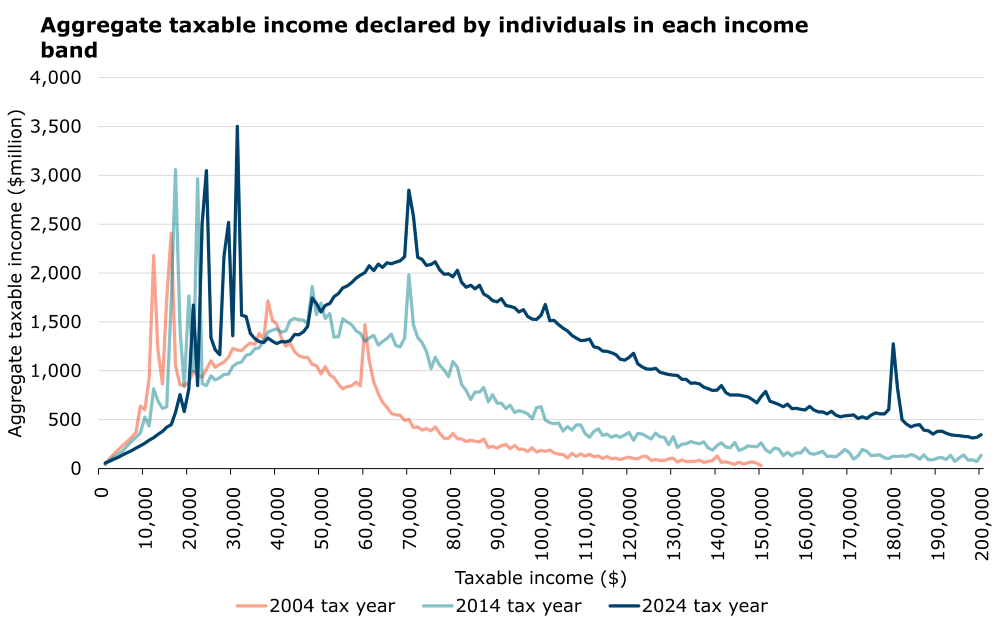

The above graph shows the total taxable income declared by individuals by income tax band for the 2004, 2014 and 2024 tax years. Individuals with taxable income between $0 and $100 are not included in the above graph. This is because of high numbers and small amounts in total. The data for these groups is available in the download link at the bottom of the page.

The graphed distribution of total taxable income shows spikes of increased values of total taxable income at various taxable income levels below $35,000. This reflects income-tested taxable benefits and New Zealand Superannuation. There are other spikes near the personal tax thresholds of $48,000, $70,000 and $180,000, where the personal tax rate increases. The $180,000 tax threshold and 39% personal tax rate applied from 1 April 2021.

In the 2004 tax year the thresholds were different, and the spikes were at $38,000 and $60,000 of taxable income. New personal tax thresholds came into effect on 31 July 2024, and their impact will first be seen in the 2025 tax year update.

The graphed distributions stop at $150,000 of taxable income for the 2004 tax year and at $200,000 for the 2014 and 2024 tax years. Upper limits are available in the download link on the page Tax on taxable income datasets.