This section contains data on the number of draft rulings issued that are counted under the timeliness measures and the average time to complete those draft rulings.

Inland Revenue has introduced new timeliness measures from 1 July 2010. These provide a target for the delivery of 90% of draft rulings (and contrary views) within three months of receipt of an application (qualifying applications), unless the application:

- raises more than eight legal issues

- has not had a pre lodgement meeting and that requirement has not been waived, or

- is an advance pricing agreement.

Applications that do not satisfy one of these three criteria are classified as non-qualifying applications and have a six month delivery timeframe from the date of receipt.

The limitation to eight issues is designed to encourage applicants to focus on the most important issues on which they seek certainty rather than applying for rulings on a large number of "nice to have" matters.

The data for these statistics is available for download from the links at the bottom of the page.

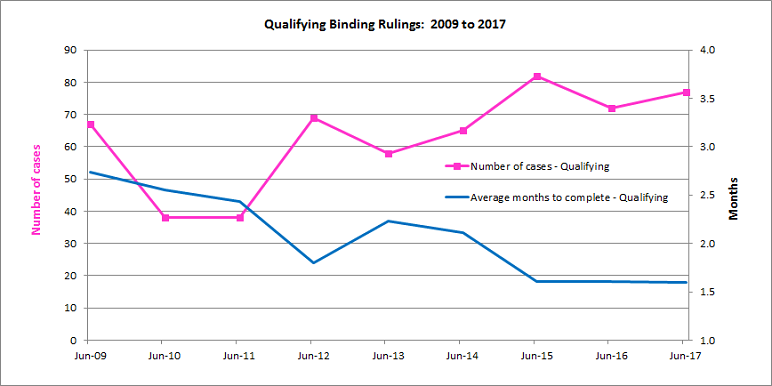

Graph of qualifying binding rulings from 2009 to 2017

This graph has two lines showing the number of qualifying binding rulings versus the average number of months taken to complete them for the period 2009 to 2017.

From 2009 to 2017 the:

- number of qualifying binding rulings cases has increased from 67 to 77 (up 15%)

- average time taken (in months) to complete the qualifying binding rulings has decreased from 2.7 months to 1.6 months (down 42%).

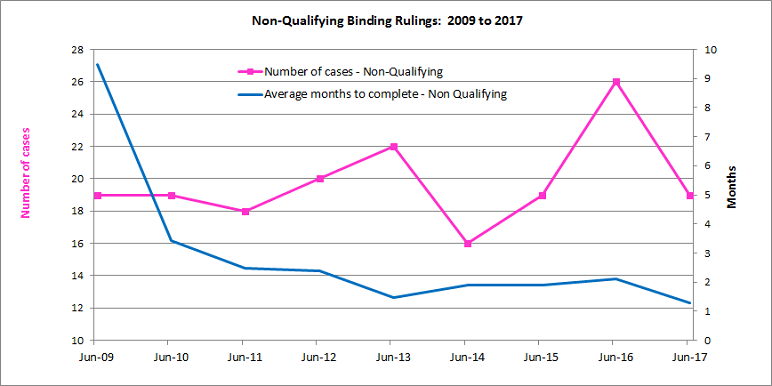

Graph of non-qualifying binding rulings from 2009 to 2017

This graph has two lines showing the number of non-qualifying binding rulings versus the average number of months taken to complete them for the period 2009 to 2017.

In 2017 there were 19 non-qualifying binding rulings cases, reverting to what it was in 2009.

From 2009 to 2017 the average time taken to complete non-qualifying binding rulings has reduced by 86% (from 9.5 months to 1.3 months).

Note:

Average time to complete rulings refers to the time (in months) between the date of receipt of the application, and the date the draft ruling is issued. It does not include the:

- time between when the fee estimate was sent to taxpayer and the date fee estimate was accepted by the taxpayer, or

- time if a project is put on hold

For the purposes of year on year comparison, the new 2010 timeliness measures have been applied retrospectively and on a best estimate basis against cases completed in the 2008/09 and 2009/10 years.

Under the new measures, timeliness is recorded from date of receipt (as opposed to date of allocation under the previous measures). Inland Revenue also categorises the applications as either qualifying or non-qualifying instead of the previous low/medium or high complexity categories.