The information represents the number of people convicted under the Tax Administration Act 1994 in each calendar year. A person may have more than one prosecution in each year.

The information is supplied by the Ministry of Justice and may differ marginally from other analyses due to timing and differences in counting cases involving:

- multiple defendants

- multiple offences

- alternative charges, and

- representative charges.

However the numbers are broadly representative of Inland Revenue's conviction activity.

The data for these statistics is available for download from the links at the bottom of the page.

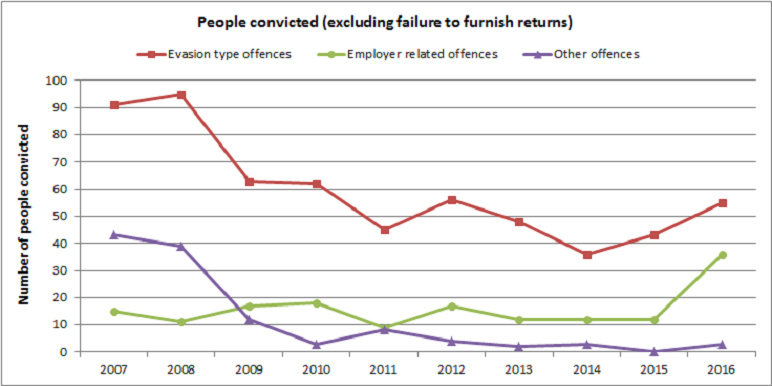

Graph of number of people convicted (excluding failure to furnish returns) from 2007 to 2016

This graph has three lines plotting for the period 2007 to 2016, the number of people convicted for following types of offences:

- evasion

- employer-related, and

- other.

Over the decade in question the number of people convicted for:

- evasion offences has reduced significantly from 91 in 2007 to 55 in 2016

- employer-related offences have tended to remain fairly stable, although between 2015 and 2016 that number tripled from 12 to 36

other offences decreased significantly between 2007 and 2016, falling from 43 to 3.

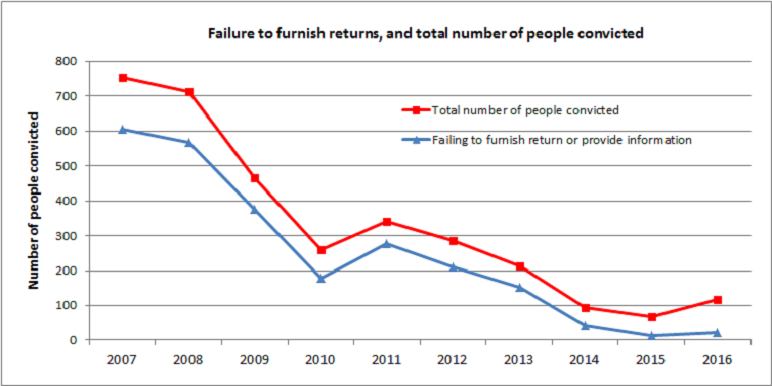

Graph of total number of people convicted from 2007 to 2016

This graph has two lines plotting the total number of people convicted under the Tax Administration Act 1994 versus the number convicted solely for failing to furnish a return or provide information for the period 2007 to 2016.

From 2007 to 2016 the number of people convicted for failing to furnish returns or to provide the required information (down 96%) has fallen in line with the total (down 85%)