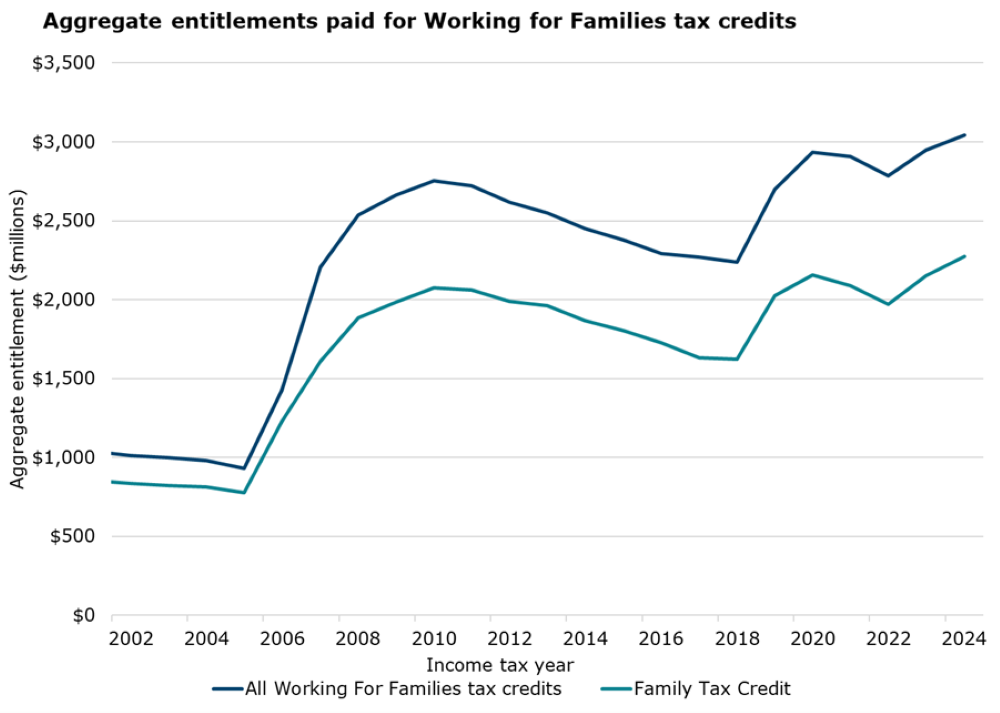

In the 2024 tax year, Working for Families tax credits (WFF) came to a total of $3,043 million. This number is a 3.2% increase from the 2023 tax year and follows 1 April 2023 changes to the Family Tax Credit and Best Start Tax Credit entitlements.

The above graph shows the total entitlements paid for WFF between 2002 and 2024. The total entitlement paid increased from $1,013 million in the 2002 tax year to $2,751 million in the 2010 tax year, following changes in the WFF entitlements during this period and the introduction of the In Work Tax Credit (IWTC) in 2007. Between 2010 and 2018, total entitlements for WFF declined to $2,238 million in 2018. Following 1 July 2018 reforms to WFF and the introduction of the Best Start Tax Credit (BSTC), total entitlements to WFF increased to $2,928 million in 2020.

Entitlements to WFF increased in the 2024 tax year and totalled $3,043 million.

The increase in total WFF expenditure in the 2024 tax year follows changes to WFF entitlements on 1 April 2023. These included:

- increasing the annual Family Tax Credit entitlement for the first child from $6,642 to $7,524

- increasing the annual Family Tax Credit entitlement for each subsequent child from $5,412 to $5,802

- increasing the annual Best Start Tax Credit entitlement for each child from $3,388 to $3,632.

Following these changes, the average amount of annual WFF paid per family increased from $8,777 in the 2023 tax year to $9,269 in the 2024 tax year.