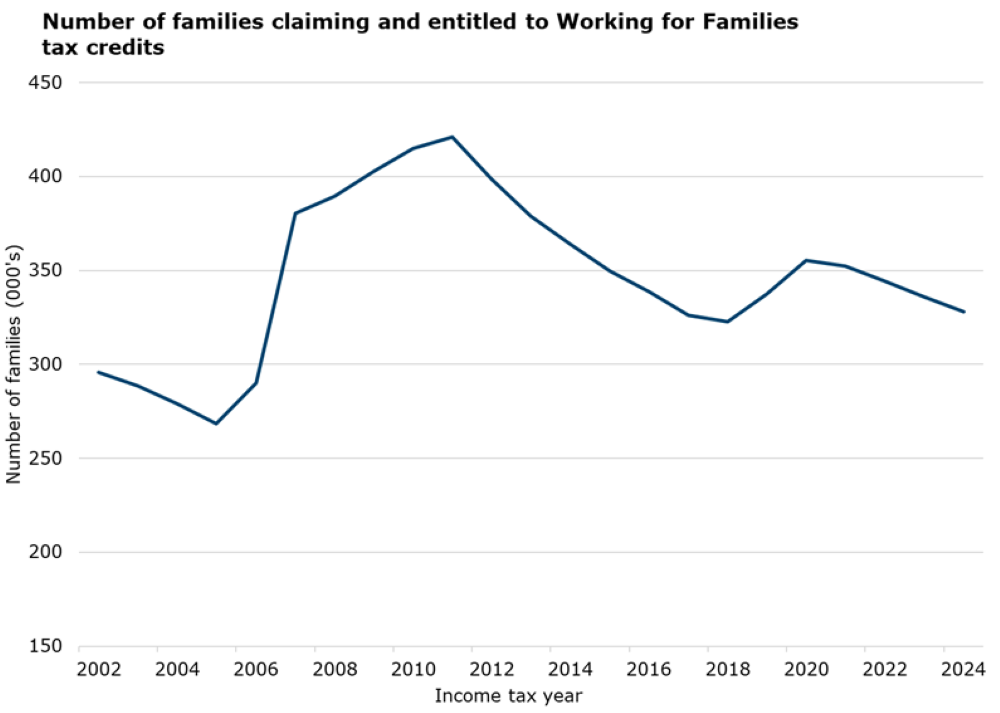

In the 2024 tax year, 328,400 families claimed and were entitled to Working for Families tax credits (WFF). This is a 2.3% decrease from the 2023 tax year.

The above graph shows the number of families claiming and entitled to WFF between 2002 and 2024. The number of families claiming and entitled to WFF increased from 295,700 in the 2002 tax year to 421,200 in the 2011 tax year. This followed increases to the WFF entitlements between 2005 and 2010.

Between 2011 and 2018, the number of families claiming and entitled to WFF decreased to 322,900. WFF entitlements depend on a family’s income. Families with higher income are entitled to less WFF. The decrease between 2011 and 2018 is linked to increasing income over this period.

On 1 July 2018, the Best Start tax credit was introduced and the Family tax credit entitlements were reformed. After these changes, the number of families claiming and entitled to WFF increased, peaking at 354,700 in the 2020 tax year.

Since 2020, the number of families claiming and entitled to WFF has decreased, due to income growth.

In the 2024 tax year, 328,400 families claimed and were entitled to WFF, a 2.3% decrease compared to the previous year.

Approximately 656,500 children were supported by WFF payments in 2024.