All data can be found in an Excel download located on the student loan dataset page. Data is updated two months post the end of each quarter.

Datasets for student loan statistics

Repayment thresholds for New Zealand-based borrowers

New Zealand-based borrowers receiving salary or wages are required to repay 12 cents of every dollar earned over the pay period repayment threshold (For example $464 per week from 1 April 2025). The deductions are considered sufficient and do not result in additional repayments provided they are within a determined threshold. If significant under-deductions occur, the employer is required to make compulsory extra deductions. Past threshold amounts are in the student loan quarterly download above.

Borrowers who earn $500 or more of adjusted net income (income that's not salary and wages and adjustments), and whose total income including salary or wages is $500 or more than the annual repayment threshold, are required to make payments on this income.

Additional information on adjusted net income can be found on our Repaying my student loan when I am self-employed or earn other income page.

Repaying my student loan when I am self-employed or earn other income

This table shows the repayment threshold by year ending 31 March (the tax year).

| Tax year | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Threshold | $20,020 | $20,280 | $21,268 | $22,828 | $24,128 |

Repayment thresholds for overseas-based borrowers

Information on the repayment thresholds for overseas-based borrowers can be found on our Repaying my student loan when I live overseas page.

Repaying my student loan when I live overseas

Student loan repayments

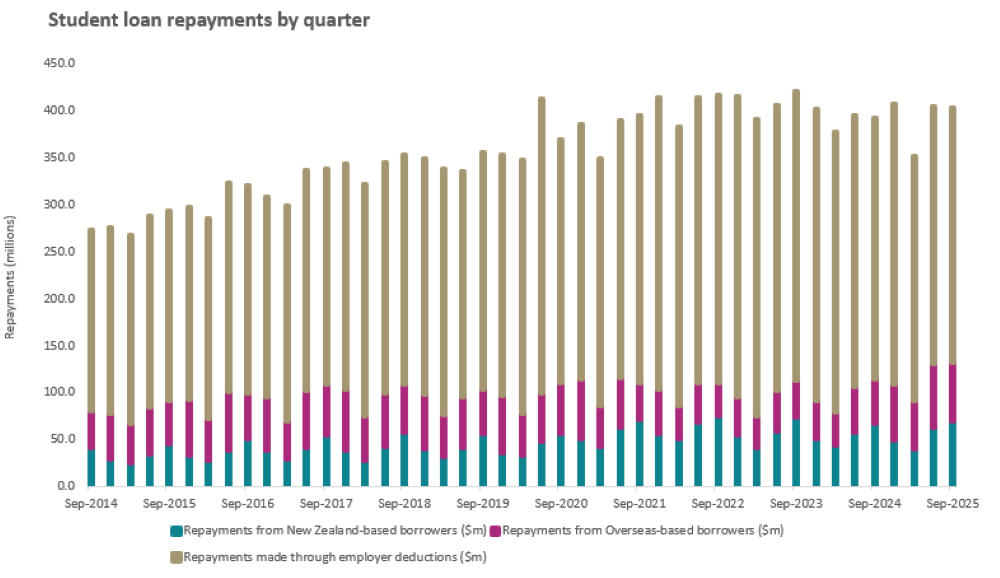

This graph shows the amount of loan repayments from employers, New Zealand-based borrowers and overseas-based borrowers as at the end of each quarter from September 2014 to September 2025.

As at 30 September 2025:

- Repayments received directly from New Zealand-based student loan borrowers increased 14.5% from $49 million in September 2024 to $56 million in September 2025.

- Repayments from overseas-based student loan borrowers increased 38.0% from $60 million in September 2024 to $83 million in September 2025.

- Repayments through employer deductions decreased 2.1% from $277 million in September 2024 to $271 million in September 2025.

- Total repayments for all borrowers increased 6.3% from $386 million in September 2024 to $410 million in September 2025.

Notes:

- The amount repaid includes all money received:

- directly from borrowers (voluntary payments, payments from borrowers with income other than salary and wages and overseas-based borrowers)

- from employers through deductions from salary or wage earners.

- The way student loan salary and wage repayment obligations were calculated changed on 1 April 2012, so each payment was considered full and final except if there were significant over or under deductions. The final "square up" payment under the previous regime was February 2013.

- A borrower is any person who has drawn from the Student Loan Scheme and not yet repaid in full.

Percent of student loan borrowers that meet their obligations

This table shows the percent of student loan borrowers who have met their obligations against Inland Revenue’s performance target of 85%, as at the end of each quarter

| Borrowers meeting obligations | 30 September 2024 | 30 September 2025 | % Change |

|---|---|---|---|

| New Zealand-based borrowers | 95% | 95.4% | 0.4% |

| Overseas-based borrowers | 21.2% | 23.6% | 2.4% |

| Total | 81.5% | 82.2% | 0.7% |

Notes:

- To be considered compliant borrowers must have met their repayment obligations. For borrowers who do not have payments made through their employers, they will meet their obligations if they pay their assessment by the due date. For borrowers who have repayments through their employers, each payment is considered full and final unless their payment resulted in a significant over or under deduction.

- A borrower is any person who has drawn from the Student Loan Scheme and not yet repaid in full.